Sample

portfolio recommendation

Sample

portfolio recommendation

ZZAlpha LTD. provides daily

recommendations of stocks that are likely to go up in value

over the next three to ten days. (We measure results

assuming a hold of 5 trading days, and continually evaluate

other hold periods.) We use an objective, proprietary and

effective machine learning technique to create the

recommendations. Our recommendation portfolios

encompass diverse liquidity, economic sector, and

capitalization groupings.

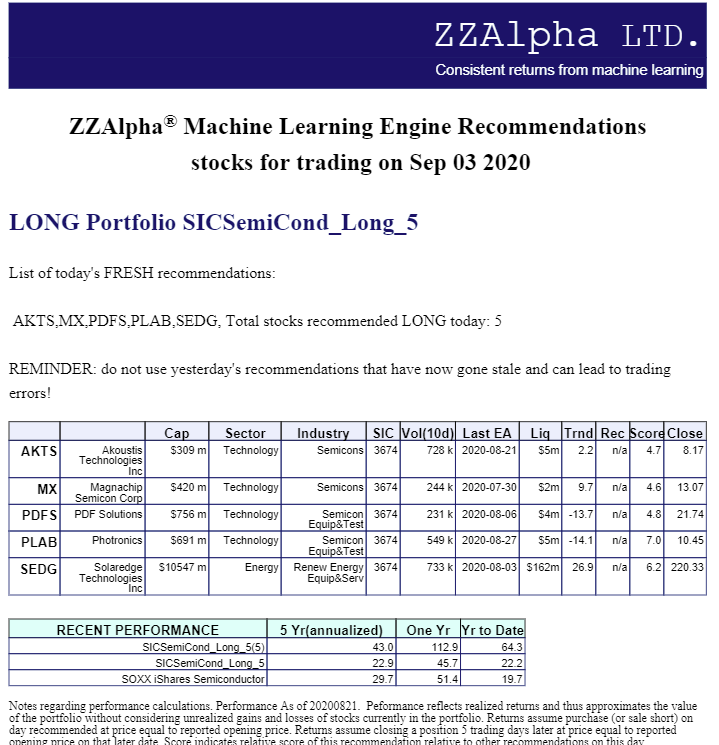

The daily emailed investment recommendation newsletter has this typical form (sample):

Note: ZZAlpha LTD. does not provide individualized investment advice, does not handle client funds, and does not buy or sell securities.

Publications

Deja vu - when contexts match, opportunities repeat. Predictive Analytics World - Financial, Las Vegas, NV, USA. June 2018. Kevin B. Pratt, Chief Scientist, ZZAlpha LTD.

Abstract- -We substantially increase investment returns in large stocks by comparing the current market context with prior contexts. The approach differs from simple auto-correlation of a few stock time-series. Contexts comprise over 5000 market and economic events. We key on the unusualness of many events within a context, and show a new similarity measure to find linkages among large sets of past events, current events, and large stock investment opportunities. We benchmark the enhanced investment returns against well-known market indices. This explains in simple terms our scientific work presented elsewhere.

Linking Many Unusual Co-Incidences. Presented at IEEE Big Data Conference, December 2017, Boston, MA, USA. Kevin B. Pratt, Chief Scientist, ZZAlpha LTD.

Presentation

slide deck here

Popularized

slide deck here

Abstract--We describe how sets of many unusual prior events can be linked and used to predict subsequent unusual events.We apply the technique to extract useful meaning from the massive, seemingly random co-incidences in the dynamics of the US stock market. We show how to qualify the links, to visualize their evolution, and to determine their similarity. We use the similarity for unsupervised clustering of sets of links. We make daily predictions over ten years that, when implemented, show excess returns in large capitalization equities in the US stock market. We begin from an insight about how our new puppy learns that she is about to get her evening walk well before we take out her leash. Our learning algorithm extends her efforts. full text available here

Proof Protocol for a Machine Learning Technique Making

Longitudinal Predictions in Dynamic Contexts. Presented at

ACM Knowledge Discovery and Datamining Conference, August

2015, Sidney, Australia. Kevin B. Pratt, Chief Scientist,

ZZAlpha LTD.

Presentation slide deck here.

Abstract: We demonstrate a protocol for proving strongly that a black-box machine learning technique robustly predicts the future in dynamic, indefinite contexts. We propose necessary components of the proof protocol and demonstrate results visualizations to support evaluation of the proof components. Components include contemporaneously verifiable discrete predictions, deterministic computability of longitudinal predictions, imposition of realistic costs and domain constraints, exposure to diverse contexts, statistically significant excess benefits relative to a priori benchmarks and Monte Carlo trials, insignificant decay of excess benefits, pathology detection and an extended real-time trial “in the wild.” We apply the protocol to a big data machine learning technique deployed since 2011 that finds persistent, exploitable opportunities in many of 41 segments of US financial markets, the existence of which opportunities substantially contradict the Efficient Market Hypothesis.

Effective Market Timing: Recent successes in five key dimensions using one-week market forecasts produced by machine learning White Paper-Sept. 24, 2011, updated March 24, 2012 . Presented at Predictive Analytics World Conference, San Francisco, CA, Feb. 2012. Kevin B. Pratt, Chief Scientist, ZZAlpha LTD.

Abstract: We demonstrate that a machine learning technique predicts relative future price in four key dimensions and an economic core of the US equities market. The price forecasts enable effective market timing selections among: a) equities vs. bonds, b) growth vs. value vs. bonds, c) large cap vs. small cap vs. bonds, d) among twelve economic sectors (including bonds) and e) economic core materials and energy sectors (and bonds). Market timing using these one-week forecasts support annualized returns over 12% for study period Jan. 2007 through Dec. 2011 using unleveraged long positions in large, well-known ETFs. The returns exceed benchmarks in the study period. The market timing also reduces risk relative to benchmarks. Using large Monte Carlo simulations, we confirm that statistical confidence in the results from the market timing recommendations exceeds three sigma (over 99.7%).

ZZAlpha Portfolios: Their performance, Risk and Usability White Paper-June 21, 2011. Kevin B. Pratt, Chief Scientist, ZZAlpha LTD.

Abstract: An introduction to the ZZAlpha Portfolios with description of sample portfolios, performance evaluation methodology, consistency of returns (2005-2010), performance, risk profiles, practical tradability, and comments on long-short equity hedging with the portfolios. Appendices include overview of the machine learning methodology, performance recording methodology, Monte Carlo trials and statistical significance, and comments on misleading risk-adjusted return statistics and bell curves.

To request a copy, please contact info@zzalpha.com