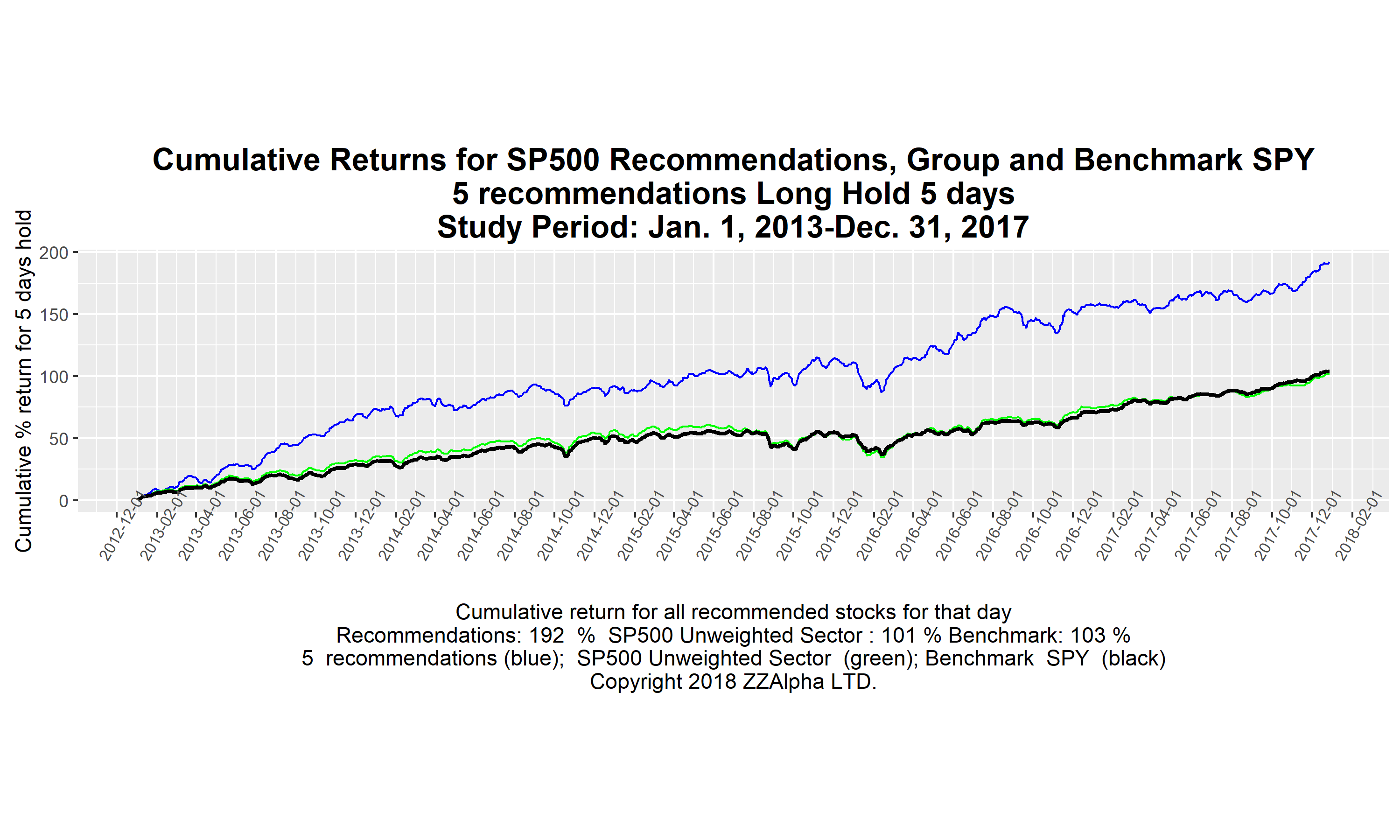

Performance measured against benchmarks

The ZZAlpha® machine

learning engine has been applied to over 20 market segments,

and results evaluated against benchmarks. As the tables

below show, in many instances over 5 year, 3 year and

single year periods, the ZZAlpha® recommendations

substantially exceeded their benchmarks. The results

come from recommendations that were certified each morning

before market open, to assure they support stringent audit.

We show here results for portfolios of 10, 5 and 2 equities, recommended daily (i.e. 50, 25 and 10 recommendations a week for each market segment).

We show here results for portfolios of 10, 5 and 2 equities, recommended daily (i.e. 50, 25 and 10 recommendations a week for each market segment).

Annualized returns for ZZAlpha® recommendation portfolios.

In 2010, we tuned the original algorithm based on the history

2006 to 2010 (which included the great recession). In

early 2021, we evaluated the algorithm with variations of the

parameter, and found there would have been better results for

the past 5 years with slightly different parameters in some

cases.

We have installed the new parameters in the production system

and hope to find that they perform better over the coming 5

years.Find returns for Q1 2021 here.

Find returns for Q2 2021 here.

Find returns for Q3 2021 here.

Find returns for Q1 2022 here.

Find returns for Q2 2022 here.

Find returns for Q3 2022 here.

"Results 2021"

"Results 2022"

Notes to tables:

1) Returns are annualized returns for multi-year periods, NOT average annual returns. Quarter, YTD and single year are returns for those periods, not annualized.

2) Benchmarks include dividend reinvestment but portfolios omit dividends.

3) We never use leverage or margin or options in evaluating results.

4) Due to a change in Sector definitions and memberships in 2018, we do not have sufficient data for some Sectors before that date.

Assumptions in performance

metrics

The results shown here are

produced by a mechanistic trading results simulator used to

evaluate all the ZZAlpha® machine learning engine

recommendations. (The evaluation is entirely distinct

from the machine learning technique.) The results shown

assume no trading commissions, no spread, no slippage and no

dividends. These results assume purchase at a price

equal to the reported opening price on the day of

recommendation and sale at the reported opening price five

trading days later. (Of course, traders often can and do

improve on this pricing assumption by scrutinizing the

market flow and news at the open or during the day.)

Real market testing

In testing by ZZAlpha

by actual market trading of various portfolio

recommendations for various periods, the actual net returns

track the evaluator model estimates.

Returns of professional

traders

The returns shown assume

mechanistic purchase at a price equal to the opening price

on the day of recommendation and sale at a price equal to

the opening price 5 trading days later. We expect that

professional traders watching market movement at open can

improve on these returns, or that speculators choosing to

sell in a 3 to 20 trading day window after purchase can

often sell above the price at open that we assume for

closing the position.

Better returns vs larger

scale

In general, smaller

portfolios have higher (but more volatile) results than

larger portfolios. Please contact us for

detailed information and statistics on portfolios of

interest.

* To be conservative, we often use both the selected index and equal weighted population means as benchmarks in our analysis of returns.

* To be conservative, we often use both the selected index and equal weighted population means as benchmarks in our analysis of returns.